In the wake of AppLovin’s Q4 2025 earnings report, analysts continue to ponder the mobile ad technology company’s future in terms of the competition (Meta and CloudX), AI and its stock price, which was down nearly 20% yesterday and 40% year-to-date, leaving the company at a $124 billion market cap.

The counter-trend: AppLovin reported a 70% increase in revenue in fiscal 2025 and similar performance in Q4. It’s rocketing, still.

On the AppLovin earnings call late Wednesday afternoon, CEO Adam Foroughi — who is an unstoppable force on earnings calls exhibiting mastery of every detail — was well aware of the instability caused by the deteriorating stock price.

And so, Mr. Foroughi began:

“I want to start by addressing what’s clearly on many people’s minds. While I prefer to ignore short-term fluctuations in the stock price and focus on maximizing value over the long term, the recent volatility warrants addressing. For the past few weeks, there’s been a lot of discussion about how AI and competition will challenge our business. But when I look at our internal dashboards, we’re delivering the strongest operating performance in our history. What’s fueling that growth is our own AI models, and as research in AI, both internal and external, continues to improve, our business will grow with it. There’s a real disconnect between market sentiment and the reality of our business.”

More:

- “Applovin Corporation (APP) Q4 FY2025 earnings call transcript” (February 11) – Yahoo Finance

- “AppLovin CEO Downplays Risks From AI” (February 11) – The Wall Street Journal (subscription)

AppLovin moves toward transparency

Foroughi’s openness on the earnings call echoed his recent post titled, “The Axon business model” (February 2) on the company’s new blog. The essay attempts to provide transparency on the company’s product line — beginning with its AI-powered Axon platform (now available in a self-serve format on a referral basis with general availability (GA) “soon”) — as well as allay concerns about a competitive threat.

Also telling is a separate blog post shortly after Foroughi’s from Giovanni Ge, the company’s Chief Product and Engineering Officer.

Mr. Ge wrote in a post titled, “Why we’re starting this blog” (February 5):

“Building leaves a lot of thinking invisible. As the scope and impact of our work has grown, we’ve accumulated a large set of lessons that are worth sharing. These lessons span engineering, product, and organizational decisions.

This blog is a place to make some of that thinking public. Over time, we’ll write about how we build, how we make decisions, and how we try to balance scale, quality, and velocity. We hope this helps others understand how we work and reflects an engineering culture we are proud of.”

Wall Street reacts

In his note to investors after the Q4 2025 earnings call on Wednesday, Morgan Stanley analyst Matthew Cost seemed impressed with AppLovin’s performance:

“We Were Also Encouraged to See the Company Push Back on Bear Cases Around AI/World Models, Meta, and CloudX: Management also pushed back on bear concerns across Meta, CloudX, and broader AI disruption narratives, all of which have contributed to AppLovin’s underperformance in recent weeks. On Meta, the company emphasized that Meta Audience Network has been a longtime bidder within APP’s ad supply and that incremental bidding activity on IDFA traffic is not new.

Importantly, they also argued the competitive landscape today is fundamentally different than five years ago (when Meta was last dominant) given AppLovin’s performance gains and the closed-loop data advantage the company has built. On CloudX, the company highlighted the moats around its MAX mediation business, arguing it is protected by the integrated 360 solution (i.e. combining best-in-class monetization with differentiated UA performance), which drives meaningful switching costs and share-of-wallet concentration for customers.”

Morgan Stanley maintained its overweight rating post-earnings call, but lowered its 12-month price target on AppLovin’s stock from $800 to $720 – nearly double the current stock price.

CloudX in the mix

Also notable is the looming presence of four-month-old startup CloudX and its mobile sell-side platform in the AppLovin narrative – noted by Morgan Stanley’s Cost.

Wall Street already sees a threat from CloudX founders Jim Payne and Dan Sack, formerly of MAX and MoPub fame. They also see Meta’s involvement in CloudX as a risk.

Payne and Sack sold the mobile app mediation platform, MAX, to AppLovin in 2018 after less than 2 years of development. Thereafter, Mr. Sack stayed at AppLovin for four years.

(Payne describes MAX as an enabler of “header bidding for in-app mobile advertising” in his LinkedIn profile.)

Eric Seufert goes deeper

In a blog post featuring his highlights from AppLovin’s earnings call, analyst Eric Seufert dissected the earnings call on Mobile Dev Memo – including Meta’s lurking impact.

He concluded, in part:

“The main issue with the defense of AppLovin’s business in these remarks on the competition point is that it positions competition on the SSP front and competition on the demand (e.g., Meta) front as being unrelated and distinct. But what if they aren’t?

As I point out in my 2026 predictions, it seems that Meta — based on commentary from CloudX’s CEO — has provided material support to CloudX.

While I think the odds of any upstart in-app SSP succeeding in stealing market share from MAX are daunting (I provide more color here), Meta’s patronage certainly doesn’t hurt. That said, AppLovin delivered a strong quarter, beating analyst expectations and guiding to higher-than-anticipated Q1 revenue. (…) The company is not imperiled.”

Related: “Podcast: Understanding AppLovin” (November 2024) – Eric Seufert on Mobile Dev Memo

More: “AppLovin Takes On Haters And Doubters As It Lays Out Its Ecommerce Ad Ambitions” (February 12) – AdExchanger

From tipsheet: One initiative to keep an eye on is AppLovin’s ecommerce advertising business which is still “early days.” The company is hoping momentum from DTC advertisers will tip their way and mesh with AppLovin’s mobile game ads biz and its other big bet, the AI-driven self-serve platform.

“No one knows what the future holds” seems to be AppLovin’s biggest, and perhaps, only problem. The business is humming (see: 70% growth rate).

LLMs & CHATBOTS

Developments

- Gemini 3 Deep Think: Advancing science, research and engineering (February 12) – Google The Keyword blog

- The AI pricing and monetization playbook (February 9) – Bessemer Venture Partners

- Anthropic raises $30 billion in Series G funding at $380 billion post-money valuation – Anthropic

From tipsheet: In case you were wondering, OpenAI’s latest rumored valuation is between $750 billion and $830 billion.

TECH

Making an MNTN of AI video

On AdExchanger, MNTN President and CEO Mark Douglas discussed his company’s momentum after MNTN’s Q4 2025 financial results were released on Tuesday.

The company’s QuickFrame AI video generation tool has become a strong focus for MNTN with 5,000+ users, he said.

AdExchanger’s Victoria McNally described a QuickFrame AI case study:

“Last week, for example, MNTN posted a QuickFrame-generated video to Instagram that features a ‘Heated Rivalry’-inspired hockey player decked out in MNTN branding (and, it should be noted, two different jersey numbers, a continuity error that would be less likely to occur during an actual film shoot).

According to Douglas, that post, which only cost roughly $500 to produce, racked up around 190,000 views and more than 2,200 likes, making it the company’s best-performing video not featuring Ryan Reynolds.”

Read more. (February 12)

SEARCH

Microsoft targets AI with Grounding API

You may recall Yahoo’s Scout chatbot leveraging Microsoft’s “Grounding API” to help deliver “informed” answers when Scout launched two weeks ago. (Yahoo indicated a chatbot search advertising product is coming in the months ahead.)

Yesterday, Microsoft Corporate VP, Search and AI, Jordi Ribas teased a new blog post on grounding and its importance on Microsoft-owned LinkedIn:

“Grounding with web data (or web RAG) is becoming a foundational layer of AI — the bridge that connects AI models to real‑time, authoritative information so the responses from AI chatbots stay fresh and accurate. At Microsoft, we’ve spent years advancing grounding technology through Bing, and today it powers nearly every major AI assistant.

As agentic AI transforms the way we access information on the web, the emergence of Generative Engine Optimization (GEO) is also changing our understanding of how content contributes to AI-generated answers, citations, reasoning, and outcomes. To facilitate this shift, we’ve just added new insights to Bing Webmaster Tools to give publishers visibility into how their content shows up across Microsoft Copilot, AI-generated summaries in Bing, and select partner chatbots. Publishers can now see the total number of citations displayed as sources, average cited pages, relevant grounding queries, page-level citation activity, and visibility trends over time across AI chatbots and experiences.

We were the first company to ship grounding at scale with Bing Chat and are proud to also be the first that provides publisher insights from the agentic web. We look forward to hearing your feedback.”

See Ribas’ post on LinkedIn. (February 12)

More: “Elevating the Role of Grounding on the AI Web” (February 12) – Microsoft Bing blog

RETAIL MEDIA

Target’s Roundel touts chatbot ads

“Starting this month, Target will be among the first companies to work with OpenAI to test contextual advertising in ChatGPT. Sponsored, contextual and clearly labeled ads from Target and from our Roundel retail media business partners will appear alongside users’ shopping conversations in ChatGPT, helping them discover products, deals and inspiration that meet what they’re seeking at that moment. (…)

As an early pilot program partner, Roundel is unlocking the opportunity for brand partners to show up in relevant moments beyond traditional media placements — and benefit from the learnings around user behavior.”

Read: Target and Roundel Test Advertising in ChatGPT (February 9) – Target

From tipsheet: Just like an agency, retail media networks can offer “special access” to opportunities such as ChatGPT ads.

Everyone is an agency.

TECH

Your lack of capex is my opportunity

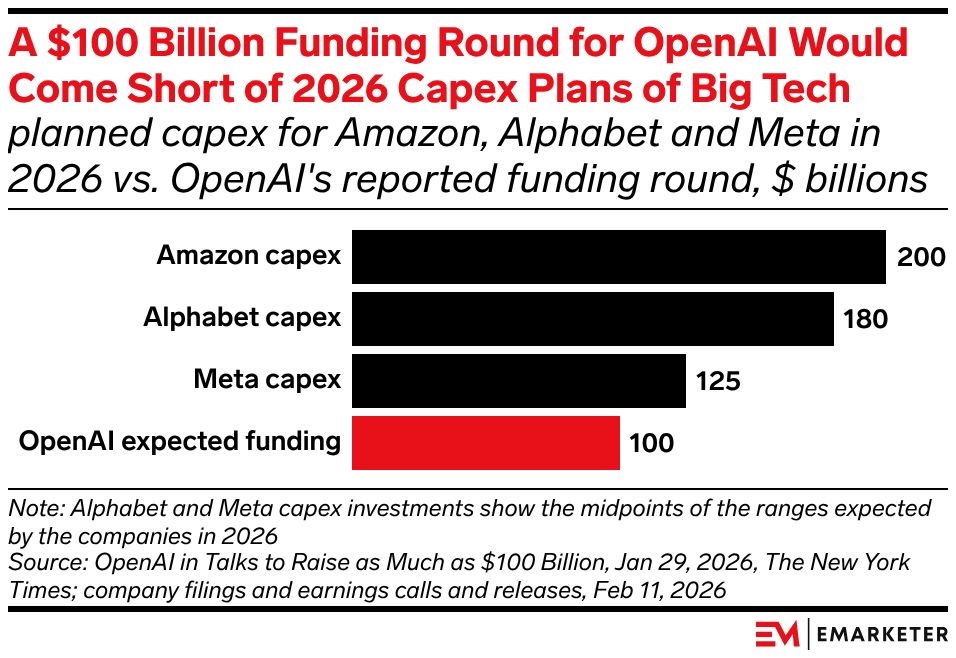

Yesterday, eMarketer Chief Content Officer Vladimir Hanzlik delivered a visualization of the capital expendtures big tech is making in AI versus insurgent OpenAI.

Public market access could help OpenAI soon, if it goes public, but its formidable AI competition is already pumping free cash flow.

Hanzlik provided a suggestion:

“What makes this even more challenging is that Amazon, Alphabet, and Meta can cover a significant share of this spend from the cash they generate, so they can keep this going, while OpenAI will either have to IPO or arrange for another monster funding round.

Seems like finding a niche (like Anthropic is doing) vs. trying to be everything to everyone might be the only path for OpenAI to thrive.”

Read more on LinkedIn. (February 12)

From tipsheet: Cash flow is king?

MORE

- With AI backlash building, marketers reconsider their approach (February 12) – Digiday (subscription)

- “LLMs produce a huge range of answers when you ask them for brand or product recommendation…” – Todd Sawicki, CEO, Gumshoe[dot]ai on LinkedIn

- Case study: “How Outloud Talent creators gained direct access to top brands — and lasting partnerships” – Agentio

- Podcast: “From Moltbook to Mars — with Steven Liss, CEO, OpenAds” (February 11) – ADSN on YouTube

- The real story behind the 53% drop in SaaS AI traffic (February 12) – Search Engine Land