People’s Vogel: Google is ‘worst’ AI shop

Google is not playing fair when it comes to compensation for AI crawling according to Fortune’s Jeff John Roberts. He reported yesterday:

“Speaking at the Fortune Brainstorm Tech conference on Wednesday, People Inc. CEO Neil Vogel—whose firm’s titles include People and Food & Wine—said other big AI firms are paying publishers to use their content, but that Google has so far refused.

‘Some AI shops are good actors. OpenAI is a good guy,’ said Vogel. ‘The worst guy is Google.’

Mr. Vogel told fellow panelists that Google searches are bringing less traffic to People Inc. websites than in the past, but “they still account for between 25% to 30% of visits, making it financially unviable to cut off the company’s crawlers.”

Read more in Fortune via MSN. (September 11)

Video: “Search Engine Zero: Who Controls the Future of Discovery” (9/10) – YouTube

From tipsheet: The publisher conundrum continues. Googlebot is the Google crawler responsible for traditional Google Search indexing and for informing the LLM(s) behind Google’s AI Overviews and AI Mode. Read Search Engine Journal in July.

If a publisher blocks Googlebot, they are removed from the two Google AI answer engine products, but they lose their listings in traditional search and its referral traffic, too.

From Google’s point-of-view, the company is trying to fend off answer engine competitor, OpenAI’s ChatGPT. This means threading the needle with publishers as it transitions its search business (and its enormous ad revenue) into a hybrid search + answer engine business.

Google needs publishers to accept Googlebot “as is” to assist in that transition.

Referrals: ChatGPT versus Google Search

Search Engine Land found new research (again!) on how referral traffic from OpenAI’s ChatGPT is comparing to Google Search.

“New data shows ChatGPT users are more engaged than Google searchers. But AI traffic comes in much smaller volumes.

Traffic from ChatGPT is now edging out Google search in user engagement, according to new Siege Media data.

By the numbers. ChatGPT traffic was 1.73% more engaged than organic search on average between 2024-2025:

ChatGPT engagement rate: 63.42% (though this number declined 11.43% since the study started).

Organic search engagement rate: 61.64% (this number increased 4.71% since the study started).”

Read more on Search Engine Land. (9/11)

Source: GA4 Engagement Rate Benchmarks: ChatGPT vs. Google [New Data] (9/9) – Siege Media

Developments

- Perplexity reportedly raised $200M at $20B valuation (9/10) – TechCrunch

- FTC Launches Inquiry into AI Chatbots Acting as Companions (9/11) – ftc.gov

- “In 2030, OpenAI projects $200B in revenue, with R&D spending hitting ~45% of that, or ~$90B; R&D costs of Alphabet and others are currently 10%-20% of revenue” (9/11) – The Information (subscription)

- OpenAI and Microsoft reach tentative deal to revise partnership (9/11) – Axios

Klarna embraces AI in marketing org

Klarna’s CMO David Sandstrom tells Adweek that AI is firmly entrenched in the fintech’s marketing department.

“The fintech firm has leaned heavily on the technology to cut costs—trimming marketing spend by 12% last year while reducing reliance on agencies—a trend Sandstrom says has only accelerated. Use of AI-driven content production in its marketing team has increased asset output by 600%, Sandstrom said.”

Read more in Adweek. (9/11)

From tipsheet: Will retail media networks buy, build or rent their AI ad tools?

It’s not touched on in the article, but Klarna has its own RMN, the Klarna media network, which claims to reach 111 million shoppers (an AdExchanger podcast in 2023 said they had 150 million users- so why the recent drop?) and has access to its shoppers’ bottom-of-the-funnel transaction data which includes their “Buy Now Pay Later” (BNPL) product.

Given the fact Klarna went public on Wednesday at a $20 billion market cap (read more in CNBC), it will be interesting to see how the company plans to invest in AI tools for the RMN given the new influx of capital. The internal embrace of AI in the marketing department is apparent from the Adweek piece.

Fintech competitor Affirm appears to have a more advanced RMN product. The company has been public since 2021 and has a $26 billion market cap and beat Klarna to market in the US with its BNPL product.

Related: From IAB Connected Commerce event: Retail Media Is Starting To Come To Grips With The Fact That We All Know Nothing (9/11) – AdExchanger

New Meta tools include more AI

Coverage of the new tools:

-

“Today at Meta’s Brand Building Summit, we’re sharing new product updates that help brands tap into culture happening on our apps, making it easier than ever to be part of the conversations that resonate with your audience.” (9/11) – Meta

-

“Meta additionally is making it easier for brands to signal their different audience priorities within Ads Manager with value rules, which allows advertisers to guide its AI to focus ad delivery on the most relevant audiences.” (9/11) – Marketing Dive

-

“Meta also announced on Thursday that it’s releasing an enhanced version of landing-page optimization, which is a feature that automatically selects the page on a brand’s website that’s most likely to lead to a conversion after someone clicks on an ad.” (9/11) – AdExchanger

Agency hold co Dentsu makes AI move

dentsu Partners with Index Exchange & Chalice AI to Build an AI-Enabled NextGen Programmatic Ecosystem (9/11) – press release

Related: Capped Budgets and the Power of Bid Strategy Targets (9/10) – George Crosby, Director, Paid Search, Dentsu UK

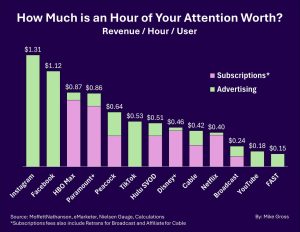

Subscription vs Ads vs Attention

Roku’s SVP of Business Insights, Michael Gross unleashed a provocative graphic yesterday “How much value can you squeeze out of an hour of attention?”

He set up the graphic on LinkedIn (9/11):

“This chart shows how much revenue different platforms generate per user hour (subscriptions + advertising). Three stories emerge:

1 – Meta are masters of monetization…

2 – Premium SVODs are maxing out yield, but not scale…

3 – Scale players earn less per hour, but have the biggest upside…”

Mr. Gross concludes, “Who has the best shot at closing the gap – Netflix, YouTube, or FAST? And how do you think this picture changes over the next few years?”

From tipsheet: The picture changes with answer engines getting added here. Especially answer engine experiences increasingly tilting toward entertainment and using both a subscription and an ad model.

However, OpenAI’s Head of ChatGPT Nick Turley said in July that his answer engine optimizes for “retention” not “time spent” (i.e. attention).

So, in theory, ChatGPT should not rank highly. But, I don’t see that happening. I see answer engines only getting smarter and more entertaining. Bring on the engagement.

Also in the future, answer engines will somehow be a part of the video/CTV universe, too.

Related: Roku wants you to see a lot more AI-generated ads (9/11) – The Verge

What sets an Agentic DSP apart?

In a LinkedIn post titled, “From Predictive to Agentic: The Evolution of DSPs“, Krishna Boppana posits that even though prediction is going to get better for demand-side platforms, the substantive change will be the “agentic DSP.”

Mr. Boppana, who is Head of Technology at healthcare ad platform IQVIA Digital, explained:

“What sets an Agentic DSP apart?

1) Predictive Core: Utilizing robust optimization models to forecast outcomes.

2) LLM-driven Context: Deciphering unstructured cues such as creative elements, conversations, and feedback.

3) Feedback Loops: Continuously adapting strategies based on unfolding results.

4) Explainability: Translating outcomes into actionable narratives for marketers.”

Read more on LinkedIn. (9/11)

All the AI deals that are fit to print

On LinkedIn yesterday, The New York Times SVP of Strategic Partnerships, Adam Greenberg, touted a new role the publisher is looking to hire: “Director, AI Partnerships & IP Management.”

After listing recent accomplishments by his group at the NYT — including the Amazon GenAI deal in May — Mr. Greenberg explained:

To build on all the momentum, we are growing the Strategic Partnerships team and our next role is a leader who will come in and craft partnerships across the AI landscape. If you love to live at the intersection of product work and BD and understand the AI ecosystem well, this could be a great fit.

Read more on LinkedIn. (9/11)

From tipsheet: This Director job will look great on a resume with its implications on the future of publishing and AI. But, the $170,000-$200,000 compensation is a flat tire. This role is at the front lines of negotiating the future success/survival of the business!

Beyond the base pay, how about a percentage of each deal included as part of the incentive package?

More

- Opinion: The Risks of AI’s $344 Billion ‘Language Model’ Bet (9/11) – Parmy Olson, Bloomberg (subscription)

- “Google updates search quality raters guidelines adding AI Overview examples & YMYL definitions” (9/11) – Search Engine Land

- Why experiential marketing will lead by 2030 (9/11) – Ad Age (subscription)

- The 4 Ps of marketing, reimagined for the AI era (9/11) – Angela Vega, Expedia, on MarTech

- AI flags Jägermeister ads in breach of code (9/11) – The Spirits Business