Publishers selling their content to AI companies in a marketplace was the subject of a feature article in The Wall Street Journal yesterday.

Microsoft’s Publisher Content Marketplace (PCM), Amazon’s rumored AWS content marketplace and Factiva (which “has deals to sell the AI rights to over 8,100 news sources in its system—more than one-quarter of all its news sources”) are among the proof points, according to the WSJ’s Alexandra Bruell.

Sell side leaders are hopeful as Bruell reported:

“‘Publishers have gotten more sophisticated when it comes to blocking AI bots,’ said Jonathan Roberts, People’s chief innovation officer. With so many companies building specialized AI products, and needing content to feed them, he said, ‘The size of the opportunity if we get it right is huge.’”

Tollbit and Cloudflare get a mention as enablers of the new marketplace opportunity.

Read: “Marketplaces Are the Next Frontier in Publisher Deals With AI Companies” (February 16) – The Wall Street Journal (subscription)

More:

- “It’s validating to see continued excitement around Microsoft’s Publisher Content Marketplace. Today’s The Wall Street Journal article is another sign that publishers are looking for scalable solutions, and I’m proud of my team’s ability to lead in this space as a key partner.” (February 16) – Tim Frank, Corporate VP, Microsoft AI on LinkedIn

- Google promises ‘more focused deals’ with news publishers as FT joins AI pilot (February 16) – Press Gazette

From tipsheet: When a B2B story makes the consumer press — it’s gotta be real!

Nevertheless, we are still waiting for an understanding of the revenue impact of the publisher content marketplace model. Today, outside of the marketplace construct, there are mostly broad licensing deals between large publishers and AI companies. Perhaps broad licensing deals are all that’s viable for now.

From here, the promise of a marketplace seems to mean something more dynamic and real-time (a la programmatic) where AI companies, their bot crawlers and publishers can easily and quickly transact.

LLMs & CHATBOTS

Developments

- “Vertical software (vs. LLMs): Are we cooked?” (February 16) – Nicolas Bustamente, CEO, Fintool on X

- AI Doesn’t Reduce Work—It Intensifies It (February 9) – Harvard Business Review

- Alibaba debuts Qwen3.5: “Towards Native Multimodal Agents” (February 15) – Qwen

PROTOCOLS

Agentic web: WebMCP, Markdown for Agents

Will agents be advertising to agents… soon? Maybe, thanks to two new initiatives.

Announced last week, Google’s WebMCP protocol and Cloudflare’s “Markdown for agents” could end up being catalysts for agent-to-agent advertising in the future.

Websites — or perhaps “web presence” — for agents are becoming a reality.

First, Google quietly announced a beta of WebMCP for the Chrome browser last week. Google developer relations engineer, André Cipriani Bandarra, explained:

“As the agentic web evolves, we want to help websites play an active role in how AI agents interact with them. WebMCP aims to provide a standard way for exposing structured tools, ensuring AI agents can perform actions on your site with increased speed, reliability, and precision.

By defining these tools, you tell agents how and where to interact with your site, whether it’s booking a flight, filing a support ticket, or navigating complex data. This direct communication channel eliminates ambiguity and allows for faster, more robust agent workflows.”

To help with agentic workflows, the new protocol proposes two new APIs: Declarative API and Imperative API.

Read:

- WebMCP is available for early preview (February 10) – Chrome for developers blog

- And, join “the Chrome built-in AI Early Preview Program.”

- Google Takes a Step Toward an Internet Built for AI Agents (February 12) – Adweek

- WebMCP Draft Community Group Report (February 12) – Web Machine Learning Community Group on Github

- WebMCP repository (originally started in August) – Github

- WebMCP.dev

Also last week, Cloudflare introduced “Markdown for agents” which transforms a website into something “friendly” for agents.

Cloudflare VP of Engineering Celso Martinho and VP of Technology Will Allen explained ‘Markdown for agents’ and its real-time content conversion capabilities:

“When AI systems request pages from any website that uses Cloudflare and has Markdown for Agents enabled, they can express the preference for text/markdown in the request and our network will automatically and efficiently convert the HTML to Markdown, when possible, on the fly.”

Read:

- “Introducing Markdown for Agents“ (February 12) – Cloudflare

- “Markdown for agents” – Cloudflare Developer Docs

From tipsheet #1: In the “Web Machine Learning Community Group” for WebMCP, Microsoft software engineer Brandon Walderman is involved (see it) along with Google engineers Khushal Sagar and Dominic Farolino.

So, WebMCP isn’t just a Google-initiated initiative and could have implications for Microsoft’s Publisher Content Marketplace (PCM) down the road.

From tipsheet #2: For advertising technologists, “Markdown for Agents” is going to have difficulty being known as the already loaded “MFA” acronym. How about M4A?

SELL-SIDE

Reaction: WebMCP, Markdown for Agents

Sell-side advocate Scott Messer dissected the WebMCP and Markdown for Agents news on LinkedIn and offered:

“The Optimist’s Take: This is incredible progress. We are finally establishing a common language for the ‘Agentic Web,’ massively reducing token overhead, and making AI workflows entirely frictionless.

The Realist’s Take: This is catastrophic for publishers and retailers who aren’t prepared.

By intentionally streamlining the web for AI agents, we are stripping away the very things that make the open web profitable: the visual UI, the display ads, the affiliate links, the impulse upsells, and the brand experience. The traditional ‘search > click > browse > buy’ funnel is collapsing into a single, invisible transaction.”

Read more. (February 16)

Regarding Google’s WebMCP, Ben Young, CEO of Nudge, said on his personal blog:

“This week, we even saw Google talk about WebMCP, a browser mechanism to access the MCP on a site. Meaning the chat assistant, accesses that on behalf of the user instead of parsing all the HTML. Smart.

But how many people have MCPs? Today, virtually no one, mainly developer tools. But expect that to change.”

B2B MARKETING

Forrester: Zero-click is only half the story

“The headline on AI search has been traffic is declining. But B2B buyers aren’t only using AI search… more than half have access to a private instance of AI behind their firewall.

They’re using AI for non-search related tasks like:

* Evaluating RFP responses

* Writing a business case

* Analysis of features from demo meetings

* Searching a buyer’s personal network for potential references

In addition to optimizing content for AI visibility, B2B marketers are going to have to start thinking about how to:

* Provide authenticated product stats to qualified prospects

* Feed product or business case “context” to AI engines

* Authorize client AI engines to access authenticated service docs…” – John Buten, principal analyst, Forrester Research on LinkedIn (February 12)

Read a bit more on LinkedIn. (February 12)

Read: “Zero-Click Is Only Half The AI Story” (February 12) – John Buten on Forrester’s blog

LLMs & CHATBOTS

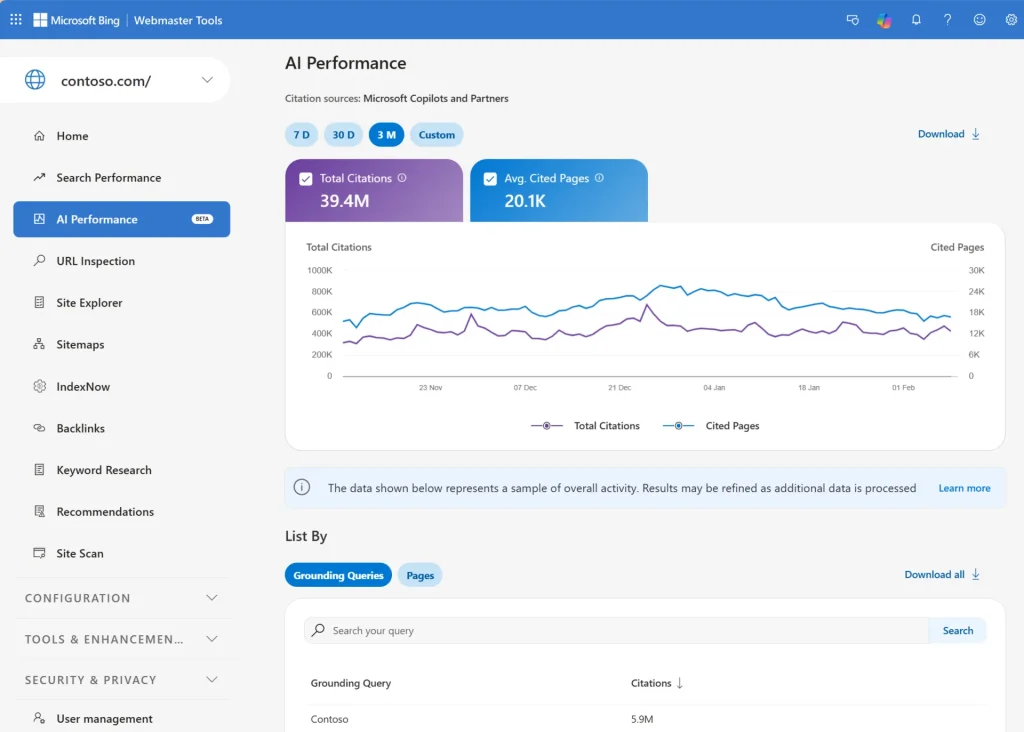

Microsoft rolls out GEO analytics

Last week, Microsoft’s Bing Webmaster Tools group for the Bing search engine quietly rolled out new generative engine optimization analytics tools. The product sheds light on website citations (by topic and page) that appear in Microsoft’s Copilot large language model (LLM) as well as “AI-generated summaries in Bing, and select partner integrations.”

The company promised that the release was an “early step” toward more GEO tools in Bing’s Webmaster Tools.

The Webmaster Tools blog post also prominently states: “Important Note: Bing respects all content owner preferences expressed through robots.txt and other supported control mechanisms.”

Read more on Bing Webmaster Tools blog. (February 10)

From tipsheet: The GEO space — including startups — continue to get busier. Why wouldn’t all answer engines roll this type of product out for their own LLM?

Perhaps offering a cross-LLM analytics and answer engine marketing platform is a way forward as well as rolling out new ad-related products. For example, see last week’s roll out of an AI retargeting tool by GEO startup Evertune.

RETAIL MEDIA

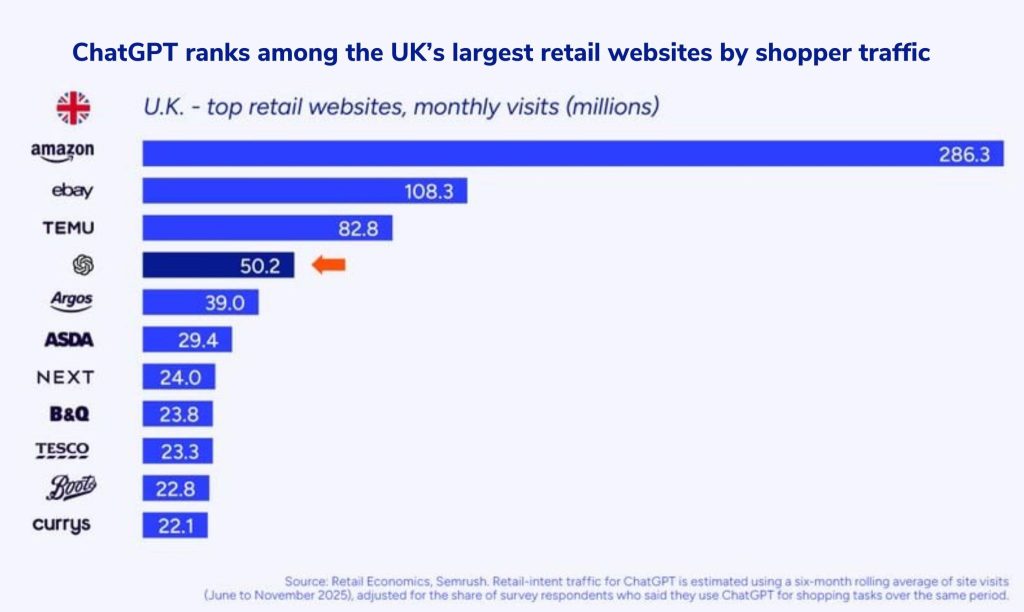

ChatGPT on the march in UK retail

Josh Holmes, Head of Research at Retail Economics in the UK, reported yesterday that OpenAI’s ChatGPT is quickly becoming a key ecommerce destination in his country according to the latest stats.

He shared a graphic (below) on LinkedIn and said:

“ChatGPT is already generating more than 50 million UK shopper visits a month, driving traffic at a scale comparable with names like Argos and Next.

We analysed total ChatGPT visits and isolated the share linked specifically to shopping tasks using consumer panel data and traffic modelling, before comparing that with monthly visits to major UK retail websites.

30% of UK consumers have used chat-based AI tools for shopping in the past 12 months. Among under-45s, it rises to almost half.”

From tipsheet: Amazon has noted OpenAI’s momentum already and has found ways to partner.

The next Amazon/OpenAI partnership is in the chatbot interface as ChatGPT uses its Instant Checkout in service to Amazon shopping. A partnership in support of Amazon’s Rufus chatbot makes sense at a high-level, too. But where does Amazon draw the line on its bottom-of-the-funnel transaction data which supports its ultra high-margin, ~$70 billion ad business?

TECH

Use case: Creative defines performance

On LinkedIn yesterday, Adverteyes CEO Max Kalehoff highlighted a case study for social media giant Snap using his company’s technology. It included a noteworthy stat.

He shared:

“Snap Inc. and Adverteyes analyzed 12,600 Snapchat performance ads and found that top-scoring creative drove 87% higher click-through conversions than bottom performers. Click-through isn’t a final business outcome. Though when you’re optimizing for online sales or lead-gen, it’s a critical lower-funnel conversion metric that determines whether your campaign even gets a chance to drive revenue.

The bigger finding: Creative quality accounts for 45% of controllable performance variation. Creative. Not targeting. Not bid strategy.”

Read more on LinkedIn. (February 16)

From tipsheet: Adverteyes was spun out by Realeyes in November 2025 in order to target the advertising vertical more specifically with Realeyes’ Vision AI identity solution known as Verifeye. At the core of Verifeye are eye-tracking capabilities using a panel of viewers with webcams or mobile device cameras.

PLATFORMS

Pinterest earnings and AI

Last Thursday, Pinterest reported Q4 2025 earnings which narrowly missed Wall Street expectations. Pinterest CEO Bill Reidy claimed on a call with analysts that tariffs hurt the company’s retail advertisers in Q4 and, consequently, reduced ad spend on the platform. Read CNBC. (February 13)

On the company’s automated AI advertising platform Performance+, which became generally available (GA) in 2025, the company reported:

“Performance Plus adoption — Shopping SKUs with paid ad impressions increased 5x since 2023; campaigns with New Customer Acquisition beta showed a 64% average increase in new customer conversions over control.”

During the call, Mr. Reidy also introduced a new customer tool:

“As part of our broader effort to give advertisers more control over expressing what matters most to them, and building upon campaign customer groups which we introduced two quarters ago, we recently entered beta for Pinterest Performance+ New Customer Acquisition.

Available exclusively through Pinterest Performance Plus campaigns, this feature helps advertisers efficiently acquire new customers by allowing them to assign their own customized values to different audiences. We can optimize toward that outcome.”

On the stock, New Street Research analyst Dan Salmon was cautious in a note to investors after the call:

“… our conviction is being tested as Pinterest enters a turnaround period. The stock is now squarely in “show me story” territory and it will take several quarters to re-organize go-to-market efforts. We don’t expect any updates on GTM intra quarter and ad product updates are unlikely to be catalysts, possibly if they cite more advertiser adoption, but that’s unlikely in our view.

We don’t see the closing of the tvScientific deal in 1Q or 2Q26 to be a catalyst either. While the team and platform got strong reviews at our latest Ad Tech Exec lunch, we don’t think management has done a good job explaining the rationale for the deal. tvScientific’s performance CTV and SMB positioning has been highlighted and that’s fine. But it hasn’t addressed why Pinterest is taking its demand off platform – where it must share economics, likely more than 50% of them – to CTV publishers that run the ad.”

Read:

- Pinterest’s Fourth Quarter 2025 results (February 12) – Pinterest Investor Relations

- Pinterest (PINS) Q4 2025 Earnings Call Transcript (February 12) – Motley Fool

From tipsheet: “What can be done to consistently boost usage and revenue on Pinterest’s owned and operated?” is the big question – as Mr. Salmon outlined. Perhaps, Pinterest’s Performance+ is a panacea.

Mr. Reidy’s Performance+ adoption comparison to 2023 numbers seemed like a stretch.

MORE

- Roku Uses Its Q4 Earnings Call To Make The Case For AI (February 13) – AdExchanger

- Podcast: “Matthew Egol of AgenticAdvertising[dot]org on Why We Need an AI-Specific Industry Association” (February 13) – Marketecture on Spotify

- Forget Jony Ive, OpenAI should hire ChatGPT to run its ads business (February 16) – Aaron Goldman, CMO, Mediaocean on LinkedIn

- “I’m still processing the MRCs new Digital Advertising Auction Transparency Standards but there is one thing that I really can’t get past…” (February 13) – Evan Thor, VP of Rev Ops, TextNow on LinkedIn

- Criteo Q4 2025 Earnings: Retail Media Troubles Overshadow Agentic Push (February 12) – Karsten Weide, analyst on W Media Research